Apart from availing audit and IPO advisory services for your business, forensic accounting is undeniably an integral part of securing your business against financial mismanagement. Financial disasters from mishandling and fraud incidents can crash your business, and no such enterprise is immune from this.

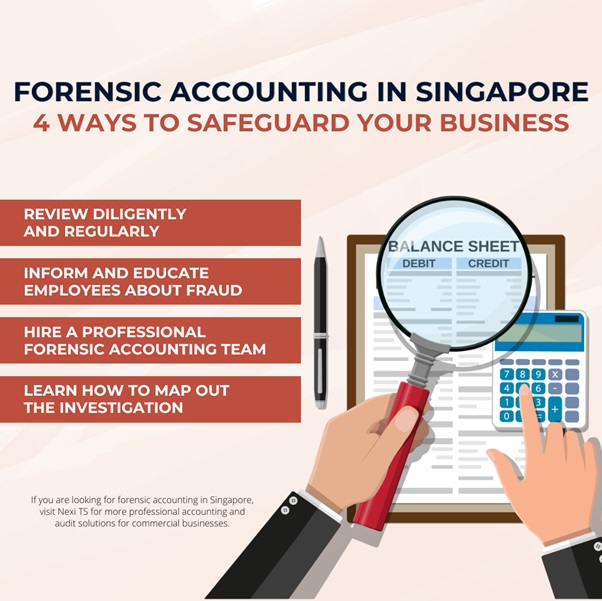

Such dishonest and fraudulent acts may plague your enterprise. From theft to embezzlement, one needs to know how to protect their business. Hence it is where forensic accounting in Singapore becomes a powerful solution. Without further ado, here are some tips on how you can safeguard your business finance involving forensic accounting:

Review diligently and regularly

Due diligence in performing internal controls, such as assessing inventory figures, credit reviews, bank accounts, etc., is integral. Detecting frauds earlier comes with having a regular routine for checking and reviewing internal control checks. In some cases, you may need to opt for a forensic accounting solution along the way if you haven’t already hired one.

Inform and educate employees about fraud

Apart from hiring useful finance and accounting solutions, such as opting for audit services in Singapore, your company will need to be informed about fraud. Informing your employees about anti-fraud is a must-implement action for internal controls to educate your organisation about the impact of fraud and how they can prevent it. It will help ensure that all are involved in knowing how to identify fraud and how they can report it.

Hire a professional forensic accounting team

Every business organisation must prioritise how to safeguard their finance and what measures they can implement to reduce the risk. One effective way to achieve the best security is to contact a professional forensic accounting team in your area should there be any suspicion of fraud in your business. Hiring a forensic accounting team will conduct an assessment/evaluation to identify weak points in your current operation and what ways to address them.

Learn how to map out the investigation

There’s a good reason that makes forensic accounting so integral, apart from other services, such as IPO advisory and data analytics for accounting. Forensic accounting focuses on mapping out investigations, from probing into disputes to locating vital financial documents. Effective forensic accounting is about having a master plan for making research and analysis before gathering any evidence necessary for reporting.

If you are looking for forensic accounting in Singapore, visit CLA TS for more professional accounting and audit solutions for commercial businesses.