Making Sure Beginners Choose The Best Broker

Forex brokers are crucial people who can influence your forex trading experience, both positively or negatively. A forex broker is a company that offers traders various services that make trading...

Should I have Short or Long Term Disability Insurance?

Navigating the world of Disability Insurance policies can feel like trying to find your way through a dense forest without a map. In Canada, where the social safety net is...

Risk Management in Healthcare: Consulting Strategies for Compliance

One of the biggest concerns for healthcare facilities is managing risks. With the ever-changing regulatory landscape and increasing complexities in the industry, it has become crucial for healthcare organizations to...

The Iterative Process of Designing Bespoke Websites

Designing the website is a process with creative, functional, and user-centered arrays that allow designing websites unique to each user's needs and conditions. Unlike ready-made solutions, uniquely designed websites have...

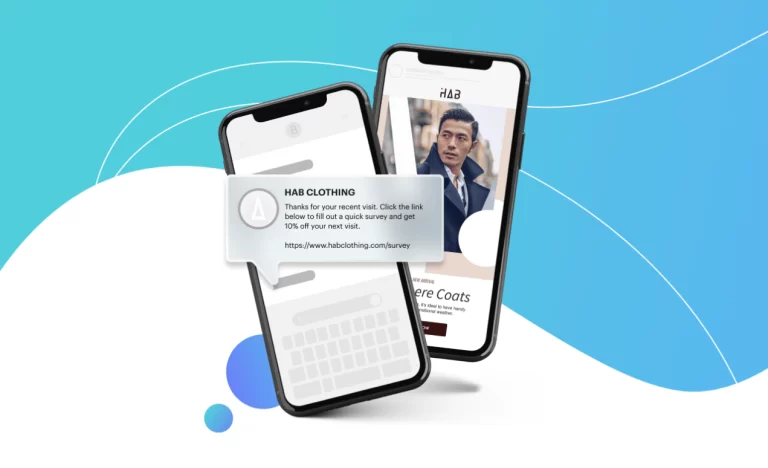

How to Implement Effective SMS Monitoring Policies in 2024?

Establishing efficient SMS monitoring strategies is essential for upholding security and compliance requirements since communication is essential to modern corporate operations. However, it can be daunting as incorporating a business...

Can a crawler telescopic crane be customized for specific job requirements?

Crawler adaptive cranes are flexible lifting machines famous for their capacity to deal with a great many undertakings in different enterprises. In any case, many might contemplate whether these cranes...

The Environmental Benefits of Professional Tree Care

Trees are an essential part of our environment and play a crucial role in maintaining the balance of the ecosystem. They provide us with oxygen, shelter for wildlife, prevent soil...

How To Manage Traffic on An Under-Construction Road?

Most cities and urban areas are set up in a way that cars, buses, and other vehicles must easily connect with key points of interest - from major highway networks...

Password protection for notes – Stepwise guide

Safeguarding sensitive information is now more vital than it has ever been before. Whether you're a student, a professional, or someone who values privacy, keeping your notes secure is essential....

Lifting Bails: Exploring Sustainable Practices for Eco-Friendly Pipe Transportation

As the environmental consciousness increases, the focus on sustainable practices extends to various sectors, including pipe transportation in the oil and gas industry. Lifting bails—an essential component in pipe handling...

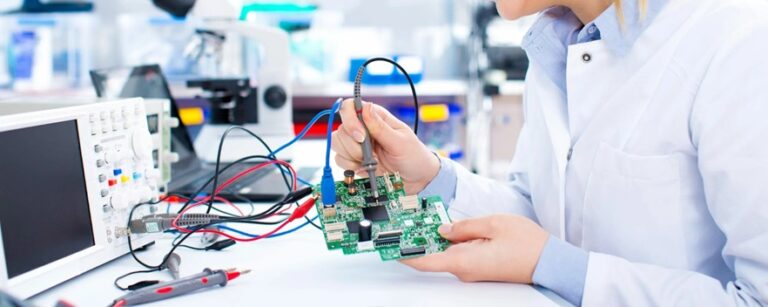

Evaluating Performance: The Role of Inverter Testing in Quality Assurance

In the realm of electrical engineering and renewable energy, inverters play a critical role in converting DC power into AC power, enabling the efficient and reliable operation of various electronic...